Renters Insurance in and around Oklahoma City

Get renters insurance in Oklahoma City

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Oklahoma City Renters!

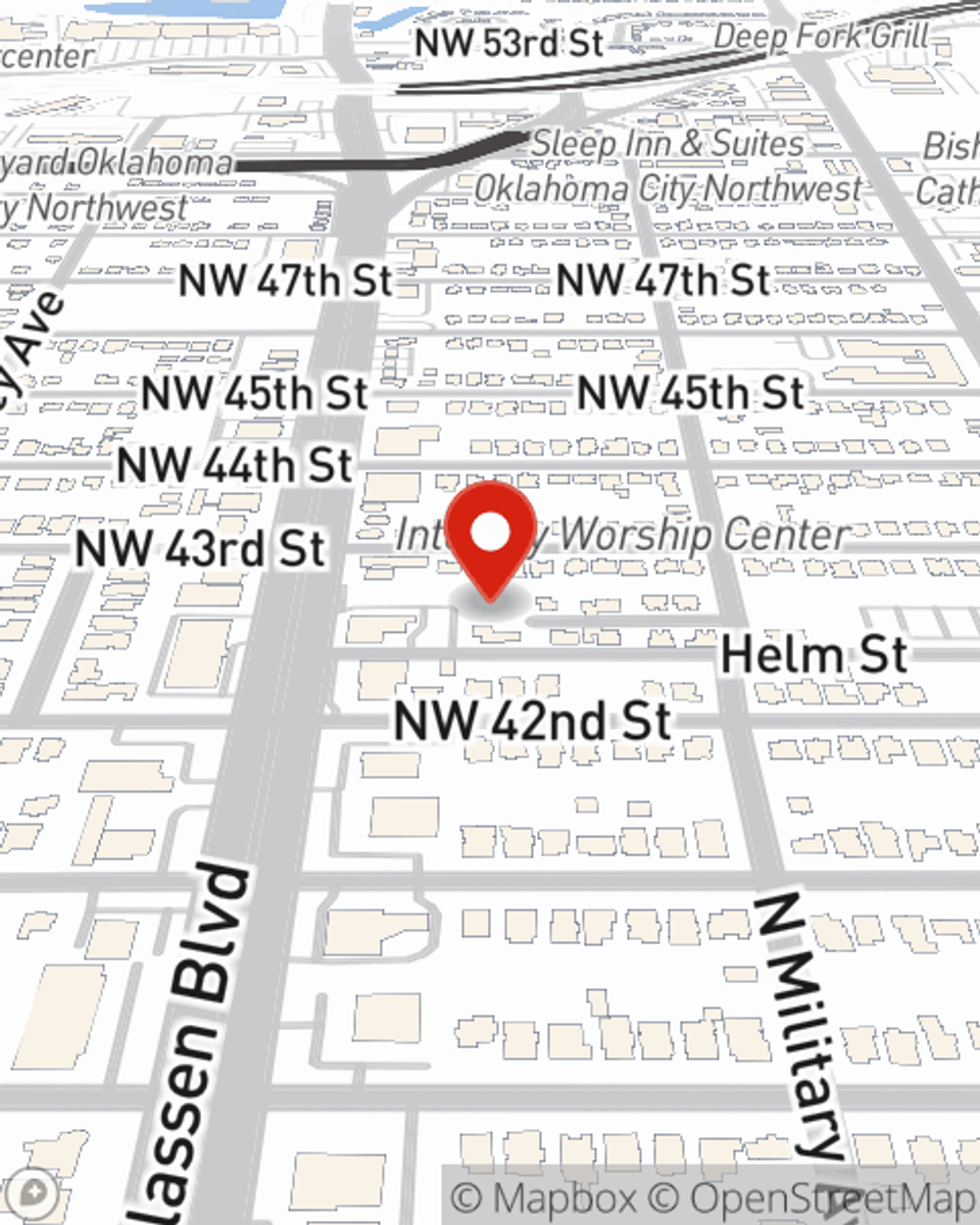

Renting a home comes with plenty of worries. You want to make sure what you own is protected in the event of some unexpected loss or damage. And you also need liability protection for friends or visitors who might become injured on your property. State Farm Agent Kenneth James is ready to help you navigate life’s troubles with dependable coverage for your renters insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Kenneth James can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Get renters insurance in Oklahoma City

Your belongings say p-lease and thank you to renters insurance

Why Renters In Oklahoma City Choose State Farm

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects the things inside the place you call home with coverage. In case of smoke damage or a burglary, some of your possessions could have damage. If you don't have enough coverage, the cost of replacing your items could fall on you. It's scary to think that in one moment, you could lose it all. Despite all that could go wrong, State Farm Agent Kenneth James is ready to help.Kenneth James can help offer options for the level of coverage you have in mind. You can even include protection for valuables beyond the walls of your home. For example, if your bicycle is stolen from work, a pipe suddenly bursts in the unit above you and damages your furniture or your personal property is damaged by a fire, Agent Kenneth James can be there to help you submit your claim and help your life go right again.

It's always a good idea to make sure you're prepared. Get in touch with State Farm agent Kenneth James for help learning more about options for your policy for your rented space.

Have More Questions About Renters Insurance?

Call Kenneth at (405) 293-9361 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Kenneth James

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.